A limited liability company, or LLC, is a popular business structure that offers many advantages for entrepreneurs and small businesses. In this article, we’ll explore the nine benefits of forming an LLC and how they can help you achieve your business goals.

What are LLCs and why are they popular?

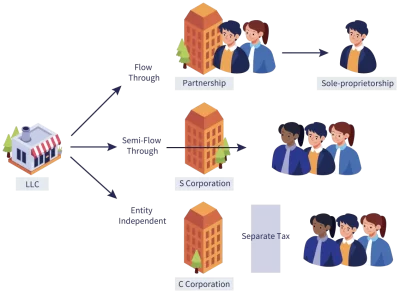

An LLC is a type of business entity or structure that combines the best features of all business types (including sole proprietorship, partnership, and corporation). It allows you to enjoy the simplicity and flexibility of running your own business while also protecting your personal assets from the liabilities of the business.

According to the US Chamber of Commerce, there are 33.2 million small businesses in the USA. Of those, 21.6 million are LLCs, making them the most common type of business entity in the country.

LLCs are popular because they are easy to set up and maintain, offer various tax benefits, and give you more control over how you run your business.

Let’s look at nine ways an LLC can benefit your SMB and how they can benefit you as an entrepreneur.

#1 Limited liability: shielding your personal assets from business liabilities

One of the best advantages of forming an LLC is that it provides you with limited liability protection. Thanks to limited liability, if your business is sued or faces debts, your assets, such as your home, car, bank accounts, and investments, aren’t at risk. Only the assets of the LLC are subject to the claims of creditors and lawsuits.

In the case of a sole proprietorship or a partnership, you’re personally liable for all the debts and obligations of the business.

If you are looking for an additional layer of protection for your assets, you might consider exploring the option of creating an offshore asset protection trust, which can further safeguard your wealth from potential lawsuits and creditors. By establishing an offshore trust, you can strategically place your assets in a jurisdiction with favorable asset protection laws, providing an extra level of security and peace of mind for your personal and business assets.

Example of limited liability protection in action

Let’s say you own an LLC that operates a landscaping service. One day, one of your employees accidentally damages a customer’s property while mowing their lawn. The customer sues your LLC for $100,000 in damages. If your LLC has only $50,000 in assets, the customer can only collect up to that amount from your LLC. Your personal assets are safe from any ?lawsuit.

However, if you were operating as a sole proprietor or a partnership, the customer could go after your personal assets to recover the remaining $50,000.

#2 Taxation perks: reducing your tax burden and increasing your profits

Another benefit of forming an LLC is that it gives you multiple options for how you want to be taxed by the IRS. Unlike a corporation, which is taxed as a separate entity from its owners, an LLC can choose to be taxed as:

- A pass-through entity

- A corporation

Depending on your situation, one option may be more tax-efficient than the other.

Pass-through taxation

LLCs allow pass-through taxation, simplifying the tax structure. As a pass-through entity, an LLC doesn’t pay any federal income tax on its profits. Instead, profits and losses are reported on ? owners’ individual tax returns, eliminating the need for separate corporate tax filings, avoiding double taxation, and ? offering other tax benefits.

Corporate taxation

As a corporation, an LLC will pay the corporate tax rate on its profits. Then, if it distributes any dividends to its members, they pay tax again on their tax returns at their dividend tax rates.

Despite the potential for double taxation, this option may be beneficial for some LLCs that want to keep more profits in the business or take advantage of certain deductions and credits available only to corporations.

#3 Single ownership LLC: having full control over your business

You may think that an LLC can only be formed by two or more individuals or entities, but that’s not the case. With an LLC, you can manage and run your own small business and have full control as the sole owner. You decide what products you’ll offer, how you’ll offer them, who you partner with on social media for your marketing efforts, and everything else.

The main perk of a single-member LLC is the ability to avoid double taxation, which you can’t avoid if you run a single-owner S corporation. The only downside to the single-member LLC is that you may have to pay self-employment tax.

#4 Management flexibility

An LLC gives you more flexibility in how you manage your business. Unlike a corporation, which has a rigid structure of directors, officers, and shareholders, an LLC can choose how it wants to be governed and operated.

Available management options for LLCs

As an LLC, you can choose to be:

- Member-managed

- Manager-managed

A member-managed LLC is one where all the members (i.e., the owners) participate in the day-to-day decision-making and operations of the business. A manager-managed LLC is one where some or all of the members delegate their authority to one or more managers, who can be either members or outsiders.

#5 A cheaper and easier way to register a business

In general, forming an LLC is cheaper and easier than forming a corporation.

To form an LLC, you only need to file a legal document called an Articles of Organization (which can sometimes be known as a Certificate of Formation) with the state where you want to do business.

The filing fee varies by state and is usually between $50 and $200. You may also need a:

- Registered agent

- Business license

- Employer identification number (EIN)

Note: These requirements depend on your state and business needs.

Filing to form a corporation, on the other hand, typically costs from $100 to $800. You also need to appoint a board of directors, elect officers, issue shares of stock, adopt bylaws, hold annual meetings, and more, making it a more cumbersome process.

#6 Increased credibility for your business

Another benefit of forming an LLC is that it can increase the credibility and legitimacy of your business. By registering your business as an LLC, you show that you are serious and committed to your venture, transmitting a sense of security to your potential customers and setting the foundations of a strong brand, which is essential for any small business’s marketing efforts.

#7 Operational flexibility

Besides flexibility on how to manage your business, LLCs also allow you to choose how to run or operate it. While a corporation has to follow strict rules and regulations imposed by the state and the federal government, an LLC can tailor its operations to suit its needs and preferences through a custom-crafted operating agreement.

There are no predefined rules for how you decide to operate, allowing you to choose the roles and responsibilities of ?members and managers, voting rights, decision-making, and more. You can even choose how to distribute its profits among its members.

Note, though, that having this flexibility doesn’t mean you should forgo some level of organization. While not mandatory in the case of an LLC, it’s still a good idea to instate regular board meetings and implement some way to log or record what’s discussed inside. In this context, data protection should be a top priority, so it’s essential to have board meeting software to store and protect all that crucial information.

Having a secure and reliable portal in hand will help to ensure that company leaders have full control over the data stored and who gets access.

#8 A separate legal identity

Liability protection is just one part of a larger benefit of setting up an LLC, which is that it acts as a separate entity from the owners in the eyes of the law. Being a legal entity means that your LLC has both rights and obligations under the law — it can own property, enter into contracts, sue and be sued, open bank accounts, get a business loan, and more.

#9 Perpetual existence

Your LLC can continue to exist even if you or any of its members die, retire, or leave the business. The LLC can also survive changes in ownership or management as long as it’s accommodated in the operating agreement. One benefit of perpetual existence is that it preserves the value and goodwill of your business, helping you avoid the hassle and out-of-pocket expense of dissolving and re-forming your business every time something happens.

Perpetual existence also helps protect one of the most important assets of any LLC, its employees, by providing job security in case of an unforeseen event. Preparing for situations like these from the ground up by choosing the right business structure shows you care for your employees. The same goes for complying with all relevant labor laws and regulations.

To ensure the latter, periodic HR compliance audits should be carried out to review the strengths and weaknesses of your organization. These audits evaluate elements such as employee management, safety in the workplace, compensation and benefits, etc. As there are many items to assess, it’s helpful to have an HR audit checklist to ensure the company is compliant and the HR department is functioning properly.

Forming an LLC does more than just protect your assets

Forming a Limited Liability Company (LLC) is compelling for numerous legal advantages. One of the primary benefits is limited personal liability, which means that the individual members (owners) are safe from personal liability for the company’s debts and legal obligations.

LLCs can also have the opportunity to choose how they want to be taxed by the IRS, allowing them to optimize their tax efficiency, leading to a more profitable company.

Furthermore, the LLC structure offers versatility in management and reduced administrative formalities compared to other business structures like corporations or sole proprietorships. The result is that members can tailor the company’s management to suit their preferences, making the LLC an excellent choice for those seeking a balanced combination of liability protection, tax advantages, and operational simplicity.

Author Bio:

Luca Ramassa Outreach Specialist at LeadsBridge, passionate about Marketing and Technology. My goal is to help companies improve their online presence and communication strategy.